Takes independent responsibility for a part of the practice, at the same time consulting with the Partner on key issues, clients and decisions

Understands the market, regionally as well as locally with a view to identifying business opportunities for the practice as well as other functions of the Firm

Actively undertakes business development with existing as well as new/ potential clients with a view to generate projects and revenue for the tax practice and other functions of the Firm

Prepares as well as participates in proposals for tax projects and multifunctional projects including proposal strategy and development, pricing of the engagement, co-ordination with other parties for inputs into the proposal, interaction with clients during the entire proposal process

Delivers high quality tax engagements that satisfy the client's requirements and match the KPMG quality standards

Maintains ongoing relationships with a portfolio of clients at various levels including the CFO and Head of Tax

Maintains ongoing relationships with other functions and network offices, as well as other relevant external contact network

Co-ordinates with other offices in a multi-office engagement, critical reviews inputs received from such offices, challenges the conclusions reached based on prior experience such that the overall deliverable to client is of high quality

Is aware of and ensures that risk processes are adhered to at all times; consults internally and with the risk team for engagement and or client processes that deviate from the standard

Ensures that practice management is up-to-date at all times including prompt submission of timesheets, client files, billing, collection, WIP review, payouts to other offices, multi-firm engagement documentation and closure of engagements on the system

Participate actively in the annual QPR process

Participates actively in the budgeting process and business plan development for the practice and assists in regular monitoring

Assists in the people plan including recruitment, on-boarding, mentoring

Actively manages teams, including effective delegation, review of work, spread of work to different managers, training on the job and constructive regular feedback

Undertakes performance manager role for team members reporting, ensures that the performance management cycle is completed effectively and in a timely manner

Participates in developing formal training plans and implementation of the training plan for team members

Acts as a mentor for team members, offers guidance and counseling as required

Communicates regularly with the partner on client, people, risk and practice management aspects and seeks inputs on all key decisions and issues

Relevant skills and behaviors:

Core and technical skills

Extensive knowledge and experience in corporate tax - tax treaty network, tax policy, tax risk management

Extensive experience in tax due diligence, tax structuring for acquisitions and divestments, acquisition support work,

Practical knowledge of tax accounting, transfer pricing and International Executive Services related tax principles

Basic awareness of VAT and other tax matters

Strong business development, client relationship and client management skills, including ability to generate opportunities, follow up on leads and convert into proposals, convert proposals into work for the Firm

Maintain relationships with key clients, potential clients, international network contacts, legal contacts etc.

Identify targets, prepare action plan for developing the client and implementation of the plan for successfully raising revenues for the firm, able to cross sell work of other functions

Strong risk management knowledge and application including documentation, ability to escalate issues quickly to risk management specialists for resolution, incorporating risk management into work environment such that it is a part of the inherent process of engagement delivery

Strong practice management skills including having in depth knowledge and experience of financials, debtors, key performance indicators including utilization, recovery, efficiency etc

Strong platform skills and report writing skills including presentation skills, facilitation and training skills, review as well as write tax structure papers, tax opinions, M&A reports and tax analyses

Strong project management skills including co-coordinating with multiple teams across various jurisdictions

Person Specifications

Good academic record

Excellent oral and written communication skills (report writing, presentations)

Good interpersonal and teamwork skills and the ability to exert leadership qualities

Linguistic Skills

Fluent English - Verbal & written, Arabic skills are an added advantage

Maintains ongoing relationships with a portfolio of clients at various levels including the CFO and Head of Tax

Maintains ongoing relationships with other functions and network offices, as well as other relevant external contact network

Co-ordinates with other offices in a multi-office engagement, critical reviews inputs received from such offices, challenges the conclusions reached based on prior experience such that the overall deliverable to client is of high quality

Is aware of and ensures that risk processes are adhered to at all times; consults internally and with the risk team for engagement and or client processes that deviate from the standard

Ensures that practice management is up-to-date at all times including prompt submission of timesheets, client files, billing, collection, WIP review, payouts to other offices, multi-firm engagement documentation and closure of engagements on the system

Participate actively in the annual QPR process

Participates actively in the budgeting process and business plan development for the practice and assists in regular monitoring

Assists in the people plan including recruitment, on-boarding, mentoring

Actively manages teams, including effective delegation, review of work, spread of work to different managers, training on the job and constructive regular feedback

Undertakes performance manager role for team members reporting, ensures that the performance management cycle is completed effectively and in a timely manner

Participates in developing formal training plans and implementation of the training plan for team members

Acts as a mentor for team members, offers guidance and counseling as required

Communicates regularly with the partner on client, people, risk and practice management aspects and seeks inputs on all key decisions and issues

Relevant skills and behaviors:

Core and technical skills

Extensive knowledge and experience in corporate tax - tax treaty network, tax policy, tax risk management

Extensive experience in tax due diligence, tax structuring for acquisitions and divestments, acquisition support work,

Practical knowledge of tax accounting, transfer pricing and International Executive Services related tax principles

Basic awareness of VAT and other tax matters

Strong business development, client relationship and client management skills, including ability to generate opportunities, follow up on leads and convert into proposals, convert proposals into work for the Firm

Maintain relationships with key clients, potential clients, international network contacts, legal contacts etc.

Identify targets, prepare action plan for developing the client and implementation of the plan for successfully raising revenues for the firm, able to cross sell work of other functions

Strong risk management knowledge and application including documentation, ability to escalate issues quickly to risk management specialists for resolution, incorporating risk management into work environment such that it is a part of the inherent process of engagement delivery

Strong practice management skills including having in depth knowledge and experience of financials, debtors, key performance indicators including utilization, recovery, efficiency etc

Strong platform skills and report writing skills including presentation skills, facilitation and training skills, review as well as write tax structure papers, tax opinions, M&A reports and tax analyses

Strong project management skills including co-coordinating with multiple teams across various jurisdictions

Person Specifications

Good academic record

Excellent oral and written communication skills (report writing, presentations)

Good interpersonal and teamwork skills and the ability to exert leadership qualities

Linguistic Skills

Fluent English - Verbal & written, Arabic skills are an added advantage

Read the Job Description, and scroll down for

"DETAILS TO REGISTER FOR THIS JOB" to APPLY...

Also, please interact with our advertisers.

It helps us keep this website FREE.

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

What is an ATS CV?

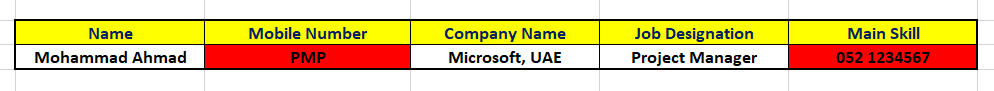

Applicant Tracking System or "ATS", is the software that 'READS' your CV and stores this information in a database. Like this:

If the CV is not made as per the RULES of the ATS, the information will get messed up in the database. Like this:

And, you may never be found by the recruiter, in spite of your 'CV information' existing in the database...

... And, you'll wonder why you get rejected in spite of being a PERFECT MATCH for the Job.

Read more about the ATS CV here:

www.dubai-forever.com/cv-writing-services.html#ATS-Compliant-CV

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

DETAILS TO REGISTER FOR THIS JOB:

NOTE: ATS-compliant CV is MANDATORY!

NOTE: ATS-compliant CV is MANDATORY!

https://www.efinancialcareers.ie/jobs-United_Arab_Emirates-Abu_Dhabi-Director_-_Corporate_Tax.id22613979

Applied For Many Jobs, But Didn't Get Any Interview Calls?

Apply For This Job Using a Branded ATS-Friendly CV from Dubai-Forever.Com.

CONTACT NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

What's the most IMPORTANT thing you should read about a CV Writing Service?

Customer Satisfaction Reviews, right?

You'll get a fair idea whether to purchase that service or not.

Read the reviews and recommendations our customers have written on my LinkedIn profile.

Visit my LinkedIn Profile, and then scroll down to the Recommendations section.

Navigate here for more testimonials/feedback about our expertise and results:

www.dubai-forever.com/resume-writing-feedback.html

www.dubai-forever.com/cv-writing-reviews.html

Also, read reviews about "www.Dubai-Forever.Com" on TrustPilot.com, the world's must trusted review site...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

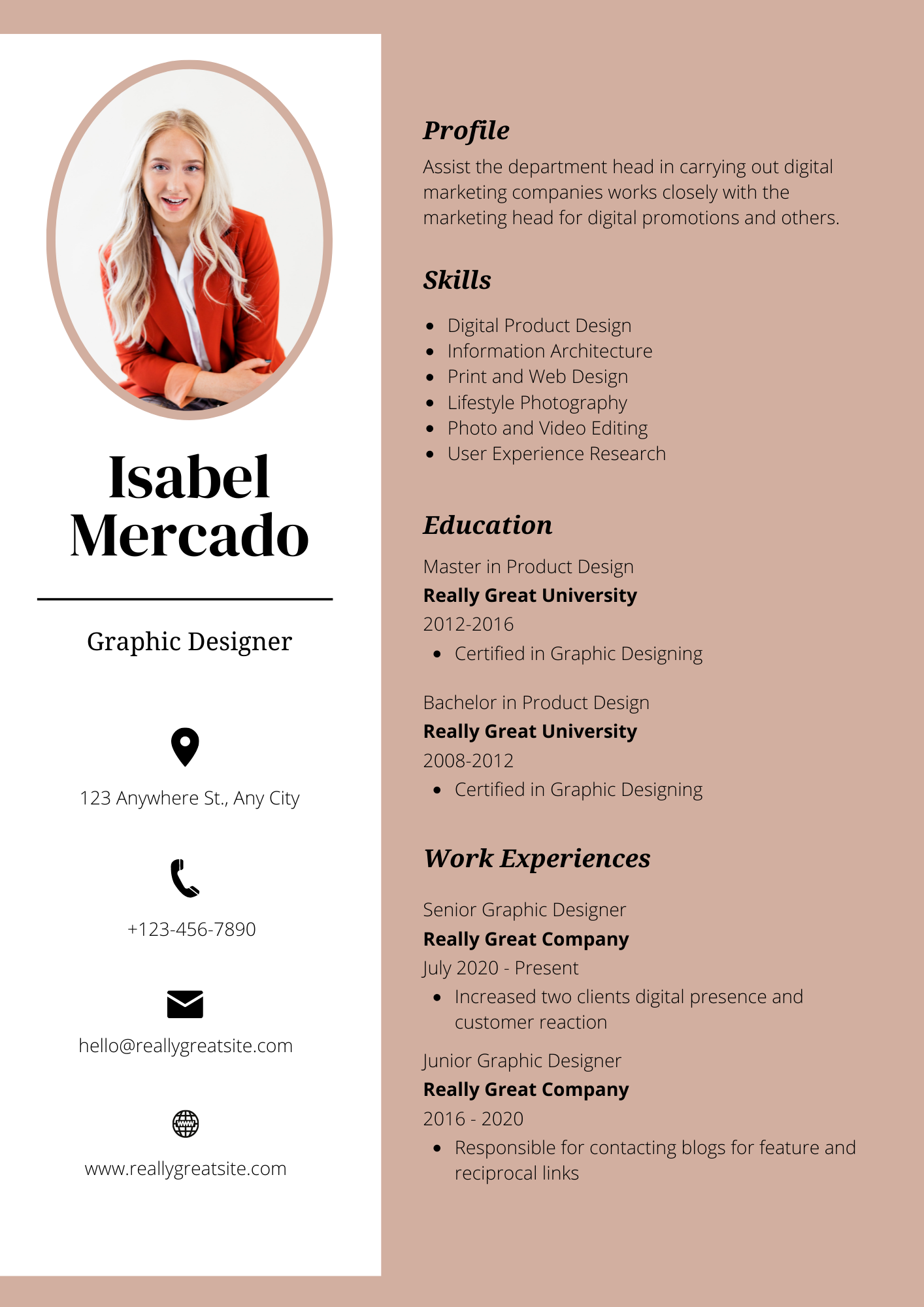

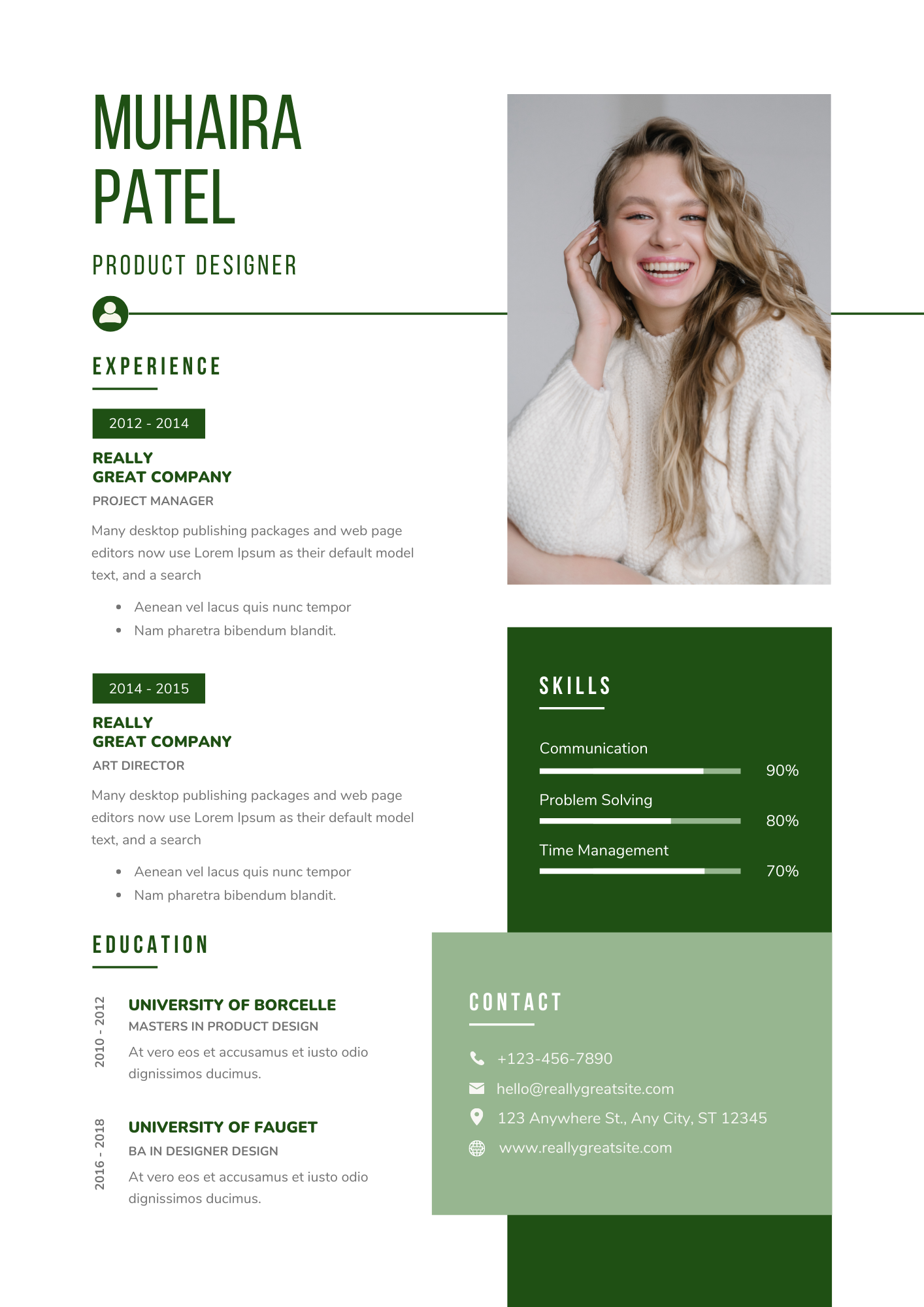

Want CV Samples & Templates for FREE?

Click on the CV's below to begin:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Fastest Growing Job Group on LinkedIn:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Middle East's Best Job Groups on Whatsapp:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join our Telegram Group:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Submit your CV here, as well:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

We support the Far-Sighted, Growth-Oriented Vision announced by the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

It's an exciting time and the next 30 - 40 years will see massive growth in jobs in the GCC countries.

Excited about working in the GCC? Click on one of the banner's below...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

SOCIAL INITIATIVE:

We publish job vacancies on this Job Portal (https://www.dubai-jobs.me) and our Whatsapp groups (www.dubai-forever.com/whatsapp-jobs.html) for the benefit of job-seekers.

It is to help people who are searching for jobs from across the world.

This is a Social Initiative from our team @ dubai-forever.com, so please help us in this Noble Task by Forwarding these jobs within your Network.

Do this GOOD DEED.

You never know who will benefit from it.

You've heard about KARMA right?

It's waiting to give you 10X of whatever you do...Do the Good Deed. NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

No comments:

Post a Comment