This job is OPEN to APPLY for ALL Nationalities, unless otherwise specified.

We need a Senior Tax Accountant,

We support peace and prosperity by building connections, understanding and trust between people in the UK and countries worldwide.

We work directly with individuals to help them gain the skills, confidence and connections to transform their lives and shape a better world in partnership with the UK. We support them to build networks and explore creative ideas, to learn English, to get a high-quality education and to gain internationally recognised qualifications.

Working with people in over 200 countries and territories, we are on the ground in more than 100 countries. In 2021–22 we reached 650 million people.

Job title: Senior Tax Accountant – UAE and Bahrain

Pay Band: 6

Country/Location: Bahrain

Department: Financial Control In-country

Contract Type: Fixed Term Contract (2 years)

Starting Salary: The gross monthly salary for this post is BHD 794

Closing Date: Monday, 3 March 2025 - 23:59 IST Time/ 18:29 UK Time

Role Purpose:

Tax accountant will be responsible for ensuring operational compliance with the local legislation governing Tax in UAE and Bahrain.

The post holder is responsible for preparing timely Tax returns, in line with legal requirements for filing, along with all related analysis, reconciliations, and, where required, language translation.

The post holder is also responsible for organizing and maintaining books and records as required under local legislation, and for supporting any inspections and audits.

Where necessary, the post holder will meet tax authorities.

The post-holder will also be the primary point of contact for operational queries and issues arising as a result of the introduction of Tax, ensuring advice offered is approved by Global Tax Team in London and/ or Deloitte as external tax advisors, where necessary.

Accountabilities:

Tax Implementation, Advisory and Compliance

- Preparation of the Tax return in a timely manner in line with the requirements of local legislation. Ensuring the Tax return is then appropriately approved internally ahead of filing

- Ensuring appropriate chart of accounts structure exists to capture data, and SAP reports exist to extract data required for Tax return

- During the initial transition period, reviewing transactions that cut across the Tax implementation date and ensuring appropriate transitional rules are applied

- Assisting with system testing associated with Tax

- Ensuring systems are up to date for Tax rate changes

- Monitoring Tax calendar, including all tax payments, to ensure compliance with UAE/Bahrain tax authority’s deadlines

- Preparation of compliance checklist covering statutory compliances that needs to be followed by British Council

- Preparation of Tax balance sheet reconciliations by set timelines.

Monitoring of Tax queries, ensuring prompt response to all issues within strict timeframe

Tax Audits

- Ensuring all necessary documents are stored as required by the local legislation, including supporting statements around areas of judgement that have been taken. Ensuring approvals which have been given by Global Tax Team and/ or technical tax advisors Deloitte

- Supporting any Tax audit process and ensuring all necessary documentation is made available

- Providing the tax inspector with the appropriate documents and analysis needed for the inspection process

Support Global Tax Team with the preparation of communications to be sent to the tax authorities

Language requirement:

English (written and spoken)

Role specific skills:

- Self-motivated and target focused

- Resilience

- Strong communication skills – including both verbal and written

- Problem solving

- Competent IT skills

Numerical skills

Role specific knowledge and experience:

Essential:

Experience of direct and indirect tax, regardless of jurisdiction in which the experience was gained.

Desirable:

Working knowledge of SAP

Requirements:

Education: Bachelor's Degree in Accountin/Finance

Condition of Employment:

Locally Recruited - Applications are welcomed from candidates currently in this location with a natural right to work.

A connected and trusted UK in a more connected and trusted world.

Equality , Diversity, and Inclusion (EDI) Statement

The British Council is committed to policies and practices of equality, diversity and inclusion across everything we do. We support all staff to make sure their behaviour is consistent with this commitment. We want to address under representation and encourage applicants from under-represented groups, in particular, but not exclusively, on grounds of ethnicity and disability. All disabled applicants who meet the essential criteria are guaranteed an interview and we have Disability Confident Employer Status. We welcome discussions about specific requirements or adjustments to enable participation and engagement in our work and activities.

The British Council is committed to safeguarding children, young people and adults who we work with.

We believe that all children and adults everywhere in the world deserve to live in safe environments and have the right to be protected from all forms of abuse, maltreatment and exploitation as set out in article 19, UNCRC (United Nations Convention on the Rights of the Child) 1989.

Appointment to positions where there is direct involvement with vulnerable groups will be dependent on thorough checks being completed; these will include qualification checks, reference checks, identity & criminal record checks in line with legal requirements and with the British Council’s Safeguarding policies for Adults and Children.

If you have any problems with your application please email askhr@britishcouncil.org

Please note: Applications to this role can only be considered when made through the Apply section of our careers website. Our ‘ASK HR’ email is only to be used in case of a technical issue encountered when applying through the careers website. Emails with supporting statements and CV/Resumes sent to this email address will not be reviewed and will be deleted.

Read the Job Description, and scroll down for

"DETAILS TO REGISTER FOR THIS JOB" to APPLY...

Also, please interact with our advertisers.

It helps us keep this website FREE.

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

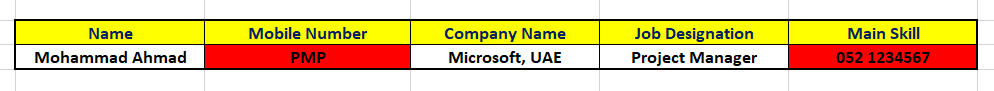

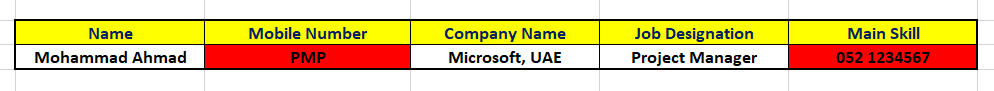

What is an ATS CV?

Applicant Tracking System or "ATS", is the software that

'READS' your CV and stores this information in a database. Like this:

If the CV is not made as per the RULES of the ATS, the information will get messed up in the database. Like this:

And, you may never be found by the recruiter, in spite of your

'CV information' existing in the database...

...

And, you'll wonder why you get rejected in spite of being a

PERFECT MATCH for the

Job.

Read more about the

ATS CV here:

www.dubai-forever.com/cv-writing-services.html#ATS-Compliant-CV

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

DETAILS TO REGISTER FOR THIS JOB:

NOTE: ATS-compliant CV is MANDATORY!

https://careers.britishcouncil.org/careers/job/563705879242814

Applied For Many Jobs, But Didn't Get Any Interview Calls?

Apply For This Job Using a Branded

ATS-Friendly CV from

Dubai-Forever.Com.

CONTACT NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

What's the most

IMPORTANT thing you should read about a

CV Writing Service?

Customer Satisfaction Reviews, right?

You'll get a fair idea whether to purchase that service or not.

Read the reviews and recommendations our customers have written on my LinkedIn profile.

Visit my LinkedIn Profile, and then scroll down to the

Recommendations section.

Navigate here for more testimonials/feedback about our expertise and results:

www.dubai-forever.com/resume-writing-feedback.htmlwww.dubai-forever.com/cv-writing-reviews.html

Also, read reviews about "www.Dubai-Forever.Com" on TrustPilot.com, the world's must trusted review site...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Want

CV Samples & Templates for FREE?

Click on the CV's below to begin:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Fastest Growing

Job Group on LinkedIn:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Middle East's Best

Job Groups on Whatsapp:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join our

Telegram Group:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Submit your CV here, as well:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

We support the

Far-Sighted, Growth-Oriented Vision announced by

the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

It's an exciting time and the next 30 - 40 years will see massive growth in jobs in the GCC countries.

Excited about working in the GCC? Click on one of the banner's below...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

SOCIAL INITIATIVE:

We publish job vacancies on this Job Portal (https://www.dubai-jobs.me) and our Whatsapp groups (www.dubai-forever.com/whatsapp-jobs.html) for the

benefit of job-seekers.

It is to help people who are searching for jobs from across the world.

This is a

Social Initiative from our team @

dubai-forever.com, so please help us in this

Noble Task by

Forwarding these jobs within your Network.

Do this

GOOD DEED.

You never know who will benefit from it.

You've heard about

KARMA right?

It's waiting to give you 10X of whatever you do...Do the Good Deed. NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

No comments:

Post a Comment