Job Summary

The incumbent is primarily responsible for the design and implementation of various Talent Management initiatives in line with the Group's business and growth strategies. The incumbent drives and leads design & effective deployment of strategies, processes, systems and tools related to Talent Management (TM), Leadership Development & Succession Planning, Employee Assessment & Development Centers, Career Planning and Development.

Main Responsibilities

A. Shareholder & Financial:

- Support senior leadership in achieving their people development strategies for the Group through the deployment

of "best practice" TM methodologies, technologies and tools that contribute to attraction, development & retention

of talented employees/ managerial personnel, and thereby facilitate the achievement of shareholder/ financial

objectives.

- Implements KPI's and best practices for Vice President Talent Management role.

- Promote cost consciousness and efficiency and enhance productivity, to minimise cost, avoid waste, and optimise

benefits for the bank.

- Act within the limits of the powers delegated to the incumbent and delegate authority to the respective staff and

monitor exercise of the same.

- Demonstrate clear understanding of the important factors behind the bank's financial & non-financial

performance.

B. Customer (Internal & External):

- Build and maintain strong and effective relationships with all internal and external stakeholders e.g wider Talent

Management, L&D, wider GHCD, business divisions, external TM vendors, Universities, QFBA etc

- Provides timely information to Executive Vice President Talent, Learning and Development, Senior Executive Vice

President GHC and other business managers, external TM vendors and consultants, as required.

- To assist customers in all their queries on Bank's product and seek solution to their requests.

- Maintain activities in accordance with Service Level Agreements (SLAs) with internal departments/units to achieve

improvements in turn-around time.

- Build and maintain strong/effective relationships with related departments/units to achieve the Group's objectives.

- Provide timely/accurate data to external/internal Auditors, Compliance, Financial Control and Risk when required.

C. Internal (Processes, Products, Regulatory):

- Drives Group QNB wide TM and Succession Planning processes, to efficiently and effectively integrate them as

business processes led by business leaders and supported by Talent, Learning and Development/GHCD

- Works with to Executive Vice President Talent, Learning and Development to spearhead Group QNB's strategic

Talent Management Initiatives such as competency framework/assessments, employee assessment, leadership &

management development, succession planning & Talent Reviews, TNA, individual development plans, career

development etc.

- Assists to Executive Vice President Talent Learning and Development with Group Culture and Organizational

Effectiveness initiatives e.g. enhancements in Performance Management framework, Employee Engagement

Surveys & other interventions.

- Establishes an organization-wide talent identification and assessment strategy to identify high potential individuals,

addressing leadership/managerial competency gaps, helping prepare employees for senior roles as part of

systematic succession planning.

- Establishes Employee Assessment infrastructure including in-house Certified Assessors and acquires necessary

assessment tools required for implementing the assessment strategy.

- Promotes TM various forums inside the Group through employee communications, workshops, presentations etc.

- Leads Top Talent Leadership & Management Development programs in partnership with Vice President Learning

& Development and Executive Management Team.

Communications and Marketing

- Develop a TM Marketing and Communications strategy for Leadership, Succession and Graduate Development

Partner with Marketing and Communication teams to ensure project and program outcomes are effectively

translated into tangible, marketable outcome

International Liaison

- Develop and maintain closer ties with International subsidiaries and branches to support development of common

international policies, procedures and approaches for TL&D issues e.g. Succession planning Vendor

Relationships

- Continuous Improvement:

- Set examples by leading improvement initiatives through cross-functional teams ensuring successes.

- Identify and encourage people to adopt practices better than the industry standard.

- Continuously encourage and recognise the importance of thinking out-of-the-box within the team.

- Encourage, solicit and reward innovative ideas even in day-to-day issues.

D. Learning & Knowledge:

- Possesses superior knowledge of TM, Leadership Development; Career Development, Employee Assessment and

Succession Planning models, frameworks, practices, methodologies and tools.

- Proactively identify areas for professional development of self and undertake development activities.

- Seek out opportunities to remain current with all developments in professional field.

- Hold meetings with staff and assess their performance and your team's overall performance on a regular basis.

- Take decisive action to ensure speedy resolution of unresolved grievances or conflicts within the team members.

- Identify development opportunities and activities for staff and facilitate/coach them to improve their effectives and

prepare them to assume greater responsibilities.

E. Legal, Regulatory, and Risk Framework Responsibilities:

- Comply with all applicable legal, regulatory and internal compliance requirements including, but not limited to,

Group Compliance Policies and Procedures (AML & CTF, Sanctions Policy, Data Protection Policy, Fraud Control

Policy, Whistle Blowing Policy, Conflict of Interest and Insider Dealing Policy).

- Understand and effectively perform your role under the Three Lines of Defence principle to identify measure,

monitor, manage and report risks.

- Ensure systematic good outcomes for clients in accordance with Conduct Risk policy.

- Support the framework of RCSA, KRI, Incident reporting and remediation, as appropriate, in accordance with the

Operational Risk Management requirements.

- Maintain appropriate knowledge to ensure full qualification to undertake the role.

- Complete all mandatory training provided by the Bank, attain, and maintain the required levels of competence.

- Attend mandatory (internal and external) seminars as instructed by the Bank.

Partner with Marketing and Communication teams to ensure project and program outcomes are effectively

translated into tangible, marketable outcome

International Liaison

- Develop and maintain closer ties with International subsidiaries and branches to support development of common

international policies, procedures and approaches for TL&D issues e.g. Succession planning Vendor

Relationships

- Continuous Improvement:

- Set examples by leading improvement initiatives through cross-functional teams ensuring successes.

- Identify and encourage people to adopt practices better than the industry standard.

- Continuously encourage and recognise the importance of thinking out-of-the-box within the team.

- Encourage, solicit and reward innovative ideas even in day-to-day issues.

D. Learning & Knowledge:

- Possesses superior knowledge of TM, Leadership Development; Career Development, Employee Assessment and

Succession Planning models, frameworks, practices, methodologies and tools.

- Proactively identify areas for professional development of self and undertake development activities.

- Seek out opportunities to remain current with all developments in professional field.

- Hold meetings with staff and assess their performance and your team's overall performance on a regular basis.

- Take decisive action to ensure speedy resolution of unresolved grievances or conflicts within the team members.

- Identify development opportunities and activities for staff and facilitate/coach them to improve their effectives and

prepare them to assume greater responsibilities.

E. Legal, Regulatory, and Risk Framework Responsibilities:

- Comply with all applicable legal, regulatory and internal compliance requirements including, but not limited to,

Group Compliance Policies and Procedures (AML & CTF, Sanctions Policy, Data Protection Policy, Fraud Control

Policy, Whistle Blowing Policy, Conflict of Interest and Insider Dealing Policy).

- Understand and effectively perform your role under the Three Lines of Defence principle to identify measure,

monitor, manage and report risks.

- Ensure systematic good outcomes for clients in accordance with Conduct Risk policy.

- Support the framework of RCSA, KRI, Incident reporting and remediation, as appropriate, in accordance with the

Operational Risk Management requirements.

- Maintain appropriate knowledge to ensure full qualification to undertake the role.

- Complete all mandatory training provided by the Bank, attain, and maintain the required levels of competence.

- Attend mandatory (internal and external) seminars as instructed by the Bank.

F. Other:

- Ensure high standards of data protection and confidentiality to safeguard commercially sensitive information.

- Maintaining utmost confidentiality concerning customer and internal bank information obtained during the course

of business and provide such information on a need to know basis only to Senior Management of QNB, Audit and

Compliance functions, and relevant Regulators.

- Maintain high professional standards to uphold QNB's reputation and to strengthen its market leadership position.

- All other ad hoc duties/activities related to QNB that management might request from time to time.

- Ensure high standards of data protection and confidentiality to safeguard commercially sensitive information.

- Maintaining utmost confidentiality concerning customer and internal bank information obtained during the course

of business and provide such information on a need to know basis only to Senior Management of QNB, Audit and

Compliance functions, and relevant Regulators.

- Maintain high professional standards to uphold QNB's reputation and to strengthen its market leadership position.

- All other ad hoc duties/activities related to QNB that management might request from time to time.

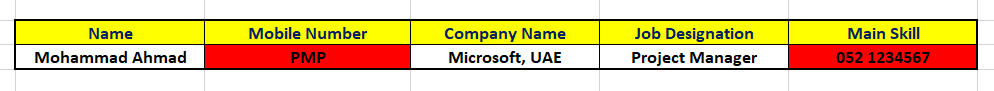

Education and Experience Requirements

Bachelor degree University Graduate/preferred with a Major in Human Resources, Business or related discipline.- At least 12 years' experience in human resources preferably with a Gulf or International Bank entailing

responsibilities of Talent Management, Assessment and Development; Leadership Development and Succession

Planning; Career Planning and Development.

No comments:

Post a Comment