This job is OPEN to APPLY for ALL Nationalities, unless otherwise specified.

Read the Job Description, and scroll down for "Details to Register for this Job" to APPLY...

Job: Operations

Primary Location: Africa & Middle East-Qatar-Doha

Schedule: Full-time

Employee Status: Permanent

Posting Date: 04/Jul/2024, 1:19:58 AM

Unposting Date: 18/Jul/2024, 5:59:00 PM

JOB SUMMARY

Build Own Operate (BOO) Client Management in the country in accordance with globally consistent standards, controls, and levels of conduct & valued behaviours. Deliver significant improvement in frontline & client experience in terms of TAT, productivity, and process improvements. Embed appropriate risk culture and standards of excellence. This will include strong emphasis and focus on:

(i) Effective delivery of quality client service based on client segment and tiering differentiation

(ii) Efficient management of client account maintenance activities

(iii) Accurate and efficient credit and client onboarding, management and offboarding processes;

(iv) Heightened awareness of AML risk, and associated controls;

(v) Effective first line risk management; credit and AML risk monitoring and remediation

(vi) Oversight of the execution of CDD; and

(vii) Management of quality Static Data

(viii) Expansion into other process to support business and risk control objectives

RESPONSIBILITIES

Strategy

Strategy & Execution

- Lead the implementation of Client Management in the country with a focus on service differentiation based on client segment / tiering and value. Ensure that the model is scalable, best-in-class, client-focused and fit for purpose of client delight

- Right scoping the Client Management model in terms of chalking out the activity inventory, capacity estimates, process flows, R&R and appropriate resourcing

- Engage all the relevant impacted teams across businesses, functions, and stakeholders to ensure Client Management seamlessly integrates into the overall TOM of CCIB with minimal business disruptions

- Fully understand the CCIB business strategy and leadership expectations and ensure Client Management activities are effectively managed in accordance with the Bank’s strategic focus

- Accelerate the shift to digital and ensure the digital value proposition is aligned with clients’ needs and preferences

- Lead local capabilities for onboarding and client management activities (e.g. cross border documentation)

- Ensure alignment between CCIB business and Client Management with regular engagement regarding business priorities, issues, and address any gaps

- Ensure alignment between onshore and offshore teams in accordance with the overall onshore-offshore client delivery model

- Reinforce synergy between countries, regions and hubs, through close communication and consistency of standards

- Spearhead the delivery of Client Management change projects, improvement, remediation activities in the country

- Continuously work on the expansion of the scope of Client Management including more processes and business segments, geographies

Business

- Lead an end-to-end Client Management model for the country and strongly support CCIB frontline to deliver beyond client expectations

- Ensure that the Client Management team is ably equipped with the best-in-class MIS, Performance Management tools, and utility functions

- Set and manage all relevant team budgets

- Develop awareness of business changes, predict challenges, and identify opportunities to optimise people & processes and add value to client & frontline

- Serve as a thought leader for the processes under Client Management within the country

- Align the priorities of Client Management with those of the business segments and country

- Close collaboration with Group, Region and Country business and function stakeholders, shared utilities, and other networks to achieve transparency and consistency of execution of the end state operating model, maintaining exemplary levels of conduct

- Effective relationship and key stakeholder management with and across the networks to identify and address issues/ concerns

- Act as the point of escalation for day-to-day client account maintenance activities to mitigate unnecessary RM involvement wherever possible. Exercise appropriate judgement on escalation items and engage the relevant internal stakeholders (Credit, Risk, Ops Heads) to resolve locally or escalate to Regional / Global CM Heads for thematic, organisational issues beyond the scope of country resolution

- Ensure thematic country client issues are raised to the Country Business Head for Client Experience forum discussions

- Ensure appropriate team capacity management to align with business and portfolio changes and engage the CC Country Head to address any gaps / issues

- Ensure overall client portfolio hygiene is maintained for the Client Management team and the team as a whole is adhering to the Bank’s policies and procedures.

Processes

- Establish a clear and uniform approach towards implementation of the global operating model for all Client Management related processes (CDD, Account Opening, Account Maintenance, S2B activation, Credit Documentation, MIS, and off-boarding), and adherence to DOIs

- Identify key processes for further streamlining, work on process improvements & fine-tuning of the operating and organizational models, and ensure optimum delivery of processes in accordance with globally consistent standards, controls, and levels of conduct & valued behaviours

- Optimise ‘speed to market’ for all Client Management processes with the aim to improve client experience, reduce ‘time to revenue’ without impact on control standards across the country

- Continuously improve productivity and efficiency of processes and people

- Drive a strong results-oriented Client Management team supported by robust data-enabled performance management tools.

- Maintain oversight on and participate in the quality & timeliness of ‘Service Review Meetings’ (SRM) to be held every month between Business Teams & Country operating teams

- Ensure roles & responsibilities and service levels are clearly defined in the Service Level Agreements (SLA) between Client Management and Business or other Functions

- Share and replicate best practices with other Country Client Management Heads / Teams.

- Drive Client Management discipline in logging client complaints in accordance with the Bank’s Complaints Policy and ensure the team fully understand their obligation to capture client complaints in WorkBench.

- Review relevant client team portfolio data/reports (ASTAR, Excess & Past Dues/ WorkBench modules, SCI, CRC/Credit, ACBS/Lending etc) to identify lead indicators/trends in portfolio quality and take proactive steps to address root cause issues

- Maintain close oversight on the discipline of timely annotation of Excess and Past Due Reports by Client Management

- Drive improved ways of working across coverage, product and functional partners, leveraging relevant meetings/forums to achieve stronger cross-functional collaboration

People & Talent

- Develop a highly engaged Client Management team in the country. Have a strong oversight on talent management and hiring in the country

- Ensure hiring decisions are aligned with the capabilities of the Client Management role profile and job description

- Ensure a high-performance team and provide appropriate training with the aim to achieve optimum quality deliveries

- Employ, engage and retain high quality people with succession planning for critical roles and appropriate recognition and reward for high performance / potential

- Lead through example and build the appropriate culture and values, embedding a high level of team engagement

- Set the appropriate tone and expectations for team and work in collaboration with risk and control partners, global process teams, and local business teams

- Ensure rollout and completion of all Client Management training programmes within the country for all staff executing relevant processes & foster cross-training of staff across managed areas

- Ensure implementation and tracking of performance metrics into the P3 of staff managed

- Formulate and monitor job descriptions and objectives for direct reports and provide feedback regularly and rewards in line with their performance against those responsibilities and objectives

- Ensure team structure / capacity is reviewed to enable effective delivery of operations & change agendas based on the bank’s strategic focus and business needs

Risk Management

- Ensure implementation of the OR Framework across managed processes

- Control operations to meet risk tolerance thresholds set for processes managed

- Proactively manage risks and establish/ monitor controls to improve the overall state of the risk management and operating framework in the country

- Work closely with Local Compliance, Credit, Legal, and Risk for guidance on complex policy/ risk issues and actively provide feedback for policy gaps and revisions required

- Provide insights and highlight risks/ mitigation to senior management, governance forums, and group teams based on understanding of country dynamics and MIS & analytics

- Manage in country or other remediations as required to ensure capability, process, or data/ docs are brought up to a best-in-class standard over time

Governance

- Responsible for delivering effective governance for Client Management in the country in compliance with applicable internal policies and external laws and regulations

- Serve as the Country Process Owner for relevant processes impacting Client Management

- Ensure that the risks are clearly identified and quantified, properly tabled in the appropriate forums and appropriate RCPS are done

- Ensure, lead, and monitor strict adherence to regulatory requirements, best practices, and a state of ever-readiness for audit & regulatory reviews, with respect to Client Management responsibilities

- Ensure the Client Management team is appropriately Risk trained/certified as stipulated in the relevant Bank policies

- Ensure alignment of GBO teams and processes supporting the country

- Senior escalation point for stakeholders on process and governance related issues in country

- Represent the Client Management function and act as an alternate to the Country CC Business Head (where applicable) in the relevant governance forums

- Delegated authorities passed on by Business Heads and Regional Client Management Head wherever required

- Work on the mechanism to track the key governance metrices set by Business Heads viz Segment Heads, CCIB Heads

- Coordinate across network to facilitate Local and Regional network business

Regulatory & Business Conduct

- Display exemplary conduct and live by the Group’s Values and Code of Conduct.

- Take personal responsibility for embedding the highest standards of ethics, including regulatory and business conduct, across Standard Chartered Bank. This includes understanding and ensuring compliance with, in letter and spirit, all applicable laws, regulations, guidelines and the Group Code of Conduct.

- Lead the Client Management Team to achieve the outcomes set out in the Bank’s Conduct Principles: Financial Crime Compliance; The Right Environment

- Effectively and collaboratively identify, escalate, mitigate and resolve risk, conduct and compliance matters.

Key stakeholders

Internal

- Region and Country CCIB Heads

- CCIB Business/GAM/FAM

- Business CCIB Finance

- CCIB HR

- Operational Risk Teams

- Client Lifecycle Design Management Teams

- Regional and country COO/ CEO/ CIO teams

- GBS Hubs / Heads

- CCIB Regional / MT members

- Legal team; in-countries, Region and Group

- Credit & Risk teams; in-countries, Region and Group

- Credit Analysts

- GIA

- Risk and Control Governance Functions ( e.g. CORC, CR etc…)

- Product Partners

- Regional CFCC CDD Controls

- Regional CDD Risk Managers

- CFCC, CDD CoE, Hubbed teams

- Global Client Management network

- COO Process owners and governance teams

External

- Local regulators & other policy makers

- External auditors

- Competitors

- Industry forums

- Vendor partners & providers of Client Management utilities & services

- Relevant Trade Associations

- Legal Firms

Other Responsibilities

- Embed Here for good and Group’s brand and values in the Client Management Team

- Perform other responsibilities assigned under Group, Country, Business or Functional policies and procedures

- Multiple functions (double hats); where applicable

Our Ideal Candidate

- Very good understanding of the business – preferably on the job business experience in CCIB

- Very good knowledge of the region – preferably a on-the job experience in the region

- Strong leadership skills – preferably an experience in leadership role in CCIB leading teams within countries.

- Good interpersonal skills in networking and influencing decisions.

- Good communication skills – oral, written and presentation

- Good product knowledge including the processes and procedures

- Strong project management skills – preferably a project experience in CCIB

- Risk & AML certified as stipulated by Bank policy (role based)

Role Specific Technical Competencies

- Manage Conduct

- Manage Risk

- Manage People

- Operational Execution

- Manage Change

- Manage Projects

- Process Management

- Data Conversion and Reporting

- Managing Regulatory Relationships

- Regulatory Reporting and Filing

- Regulatory Liaison

Visit our careers website www.sc.com/careers

DETAILS TO REGISTER FOR THIS JOB:

NOTE: ATS-friendly CV is COMPULSORY!

https://scb.taleo.net/careersection/ex/jobdetail.ftl?job=256112

Applied For Many Jobs, But Didn't Get Any Interview Calls?

Apply For This Job Using a Branded

ATS-Friendly CV from

Dubai-Forever.Com.

CONTACT NOW!

What is an ATS CV?

Applicant Tracking System or "ATS"

What is an ATS CV?

Applicant Tracking System or "ATS", is the software that

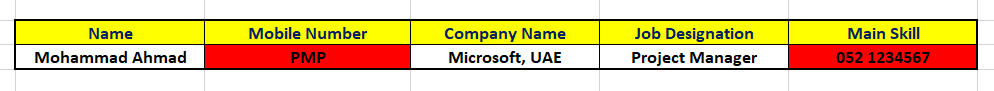

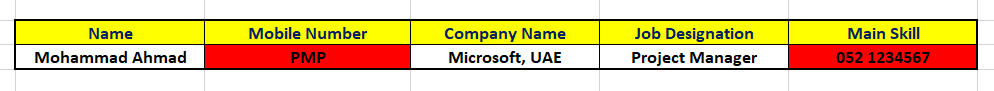

'READS' your CV and stores this information in a database. Like this:

If the CV is not made as per the RULES of the ATS, the information will get messed up in the database. Like this:

And, you may never be found by the recruiter, in spite of your

'CV information' existing in the database...

...

And, you'll wonder why you get rejected in spite of being a

PERFECT MATCH for the

Job.

Read more about the

ATS CV here:

www.dubai-forever.com/cv-writing-services.html#ATS-Compliant-CV

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

What's the most

IMPORTANT thing you should read about a

CV Writing Service?

Customer Satisfaction Reviews, right?

You'll get a fair idea whether to purchase that service or not.

Read the reviews and recommendations our customers have written on my LinkedIn profile.

Visit my LinkedIn Profile, and then scroll down to the

Recommendations section.

Navigate here for more testimonials/feedback about our expertise and results:

www.dubai-forever.com/resume-writing-feedback.htmlwww.dubai-forever.com/cv-writing-reviews.html

Also, read reviews about "www.Dubai-Forever.Com" on TrustPilot.com, the world's must trusted review site...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

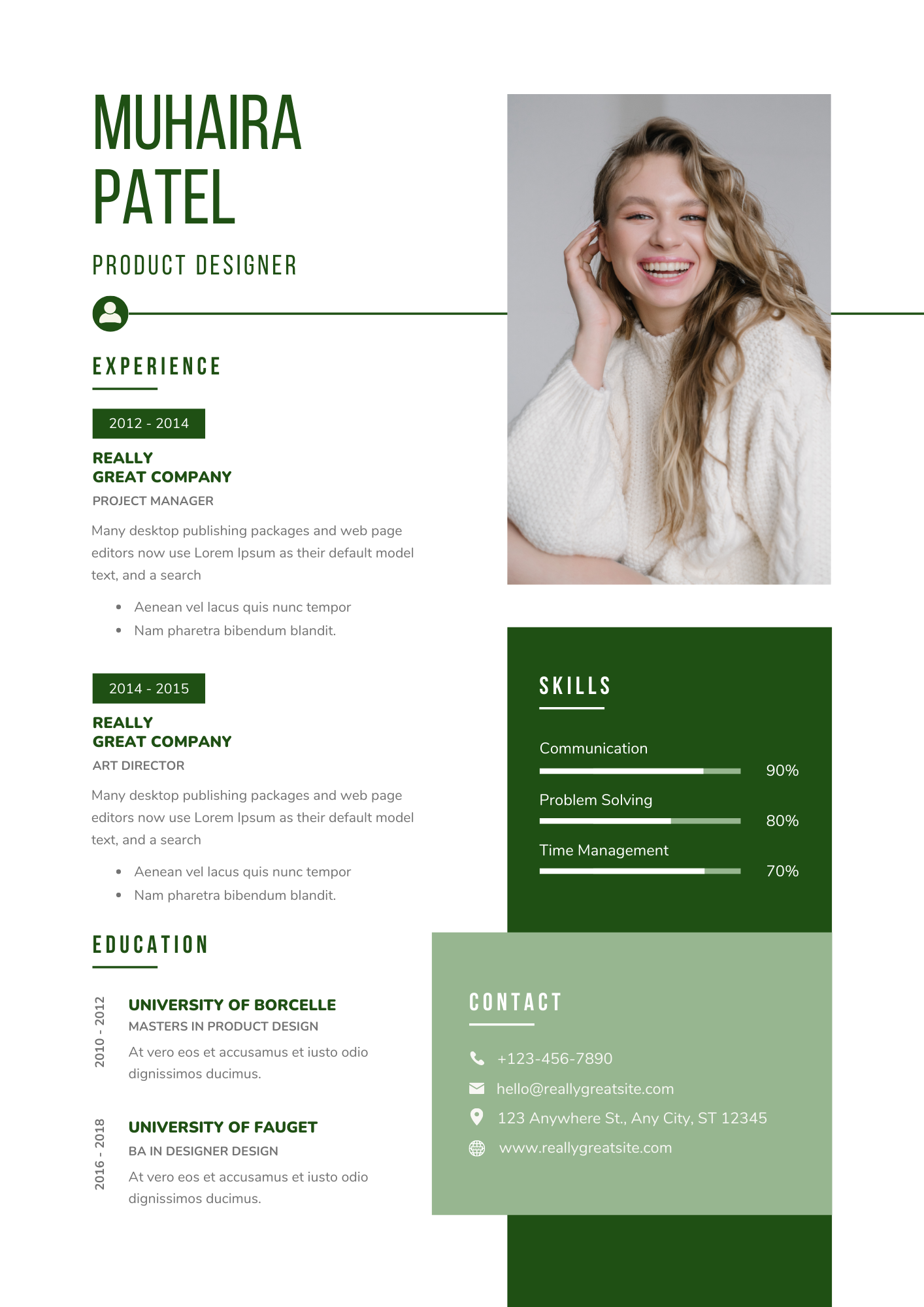

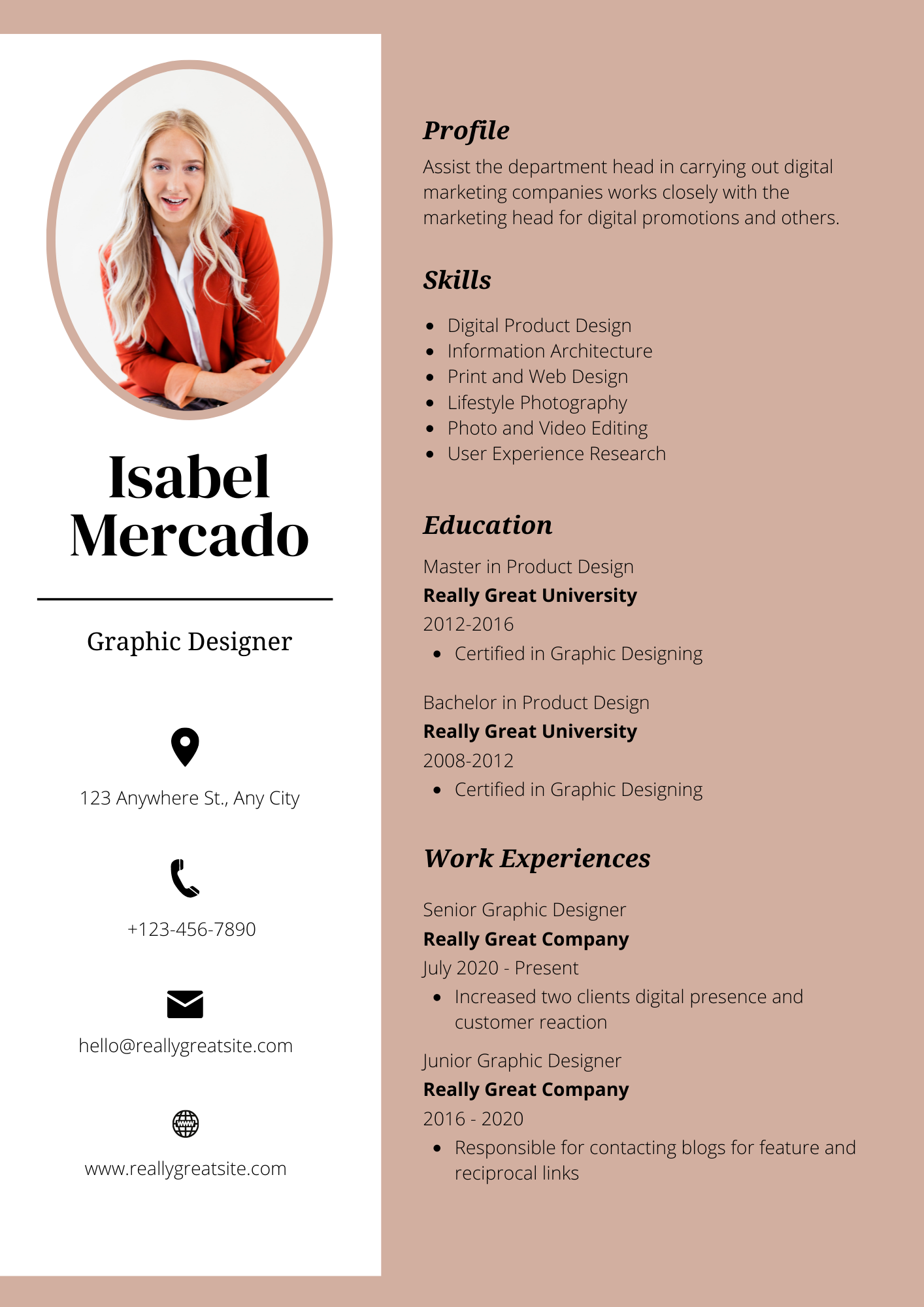

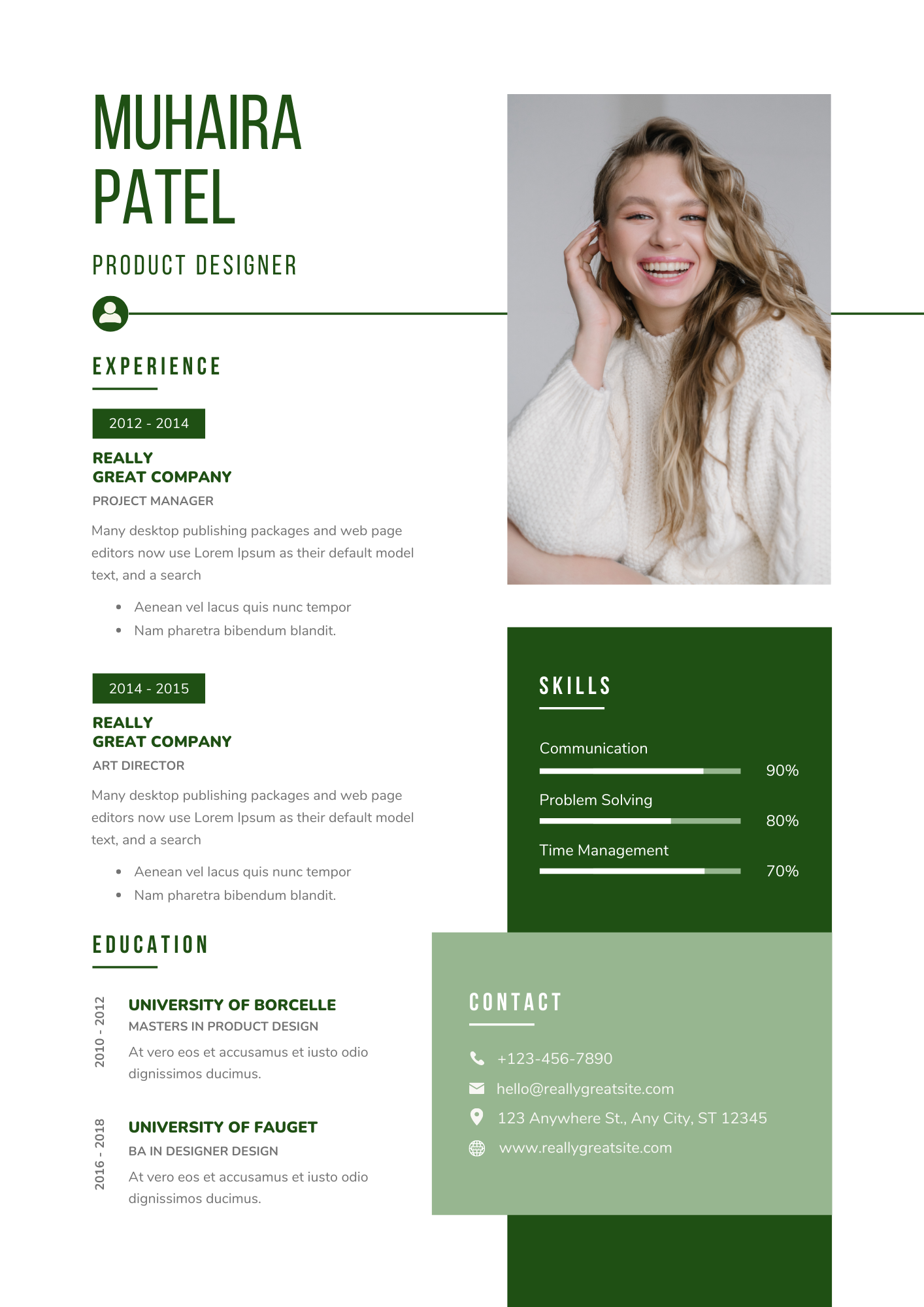

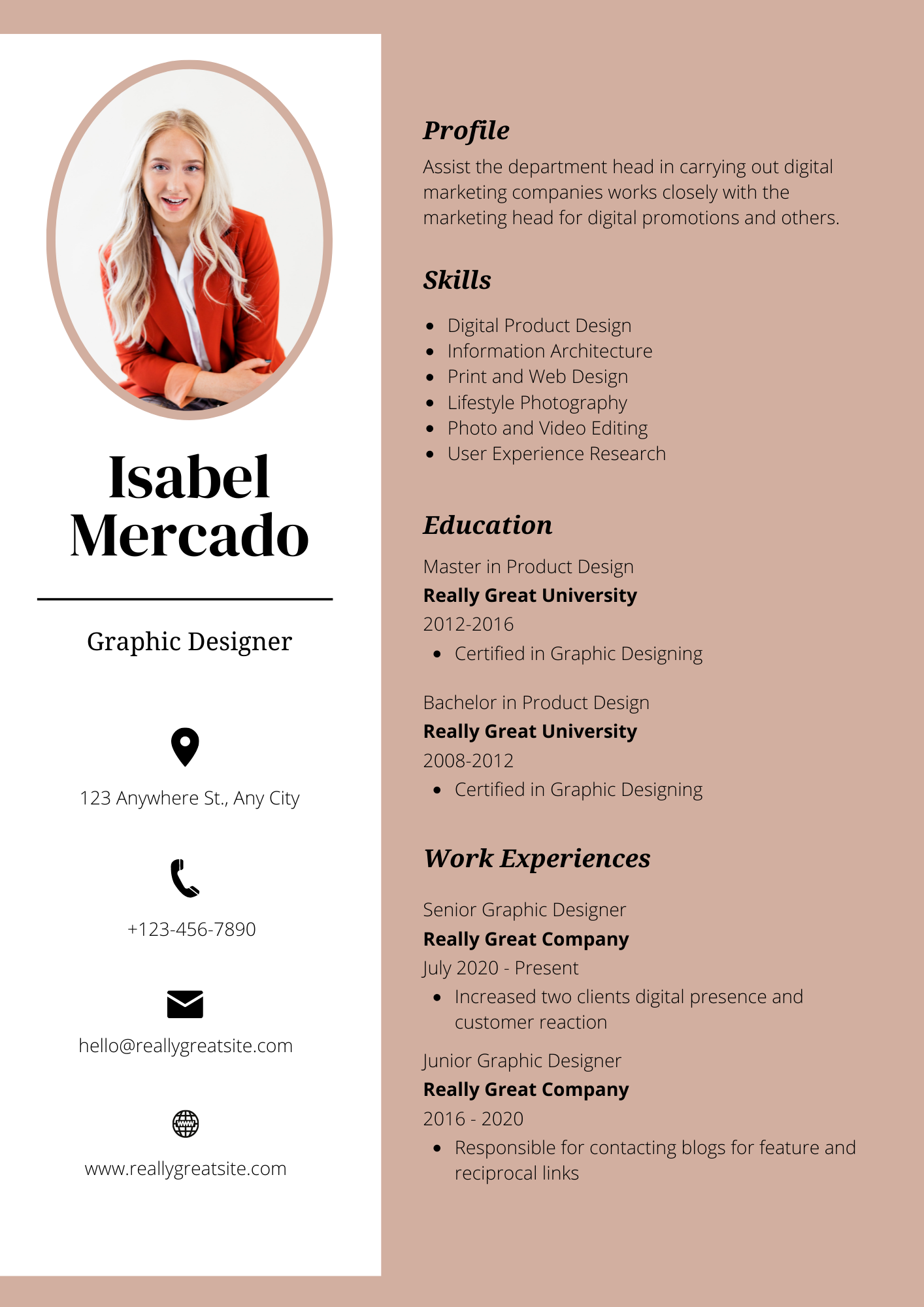

Want

CV Samples & Templates for FREE?

Click on the CV's below to begin:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Fastest Growing

Job Group on LinkedIn:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Middle East's Best

Job Groups on Whatsapp:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join our

Telegram Group:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Submit your CV here, as well:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

We support the

Far-Sighted, Growth-Oriented Vision announced by

the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

It's an exciting time and the next 30 - 40 years will see massive growth in jobs in the GCC countries.

Excited about working in the GCC? Click on one of the banner's below...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

SOCIAL INITIATIVE:

We publish job vacancies on this Job Portal and our Whatsapp groups for the

benefit of job-seekers.

It is to help people who are searching for jobs from across the world.

This is a

Social Initiative from our team @

dubai-forever.com, so please help us in this

Noble Task by

Forwarding these jobs within your Network.

Do this

GOOD DEED.

You never know who will benefit from it.

You've heard about

KARMA right?

It's waiting to give you 10X of whatever you do...Do the Good Deed. NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

No comments:

Post a Comment