Read the Job Description carefully, then scroll down for "Details to Register for this Job"...

Company: Al Futtaim Private Company LLC

Job Requisition ID: 159911

Established in the 1930s as a trading business, Al-Futtaim Group today is one of the most diversified and progressive, privately held regional businesses headquartered in Dubai, United A”rab Emirates. Structured into five operating divisions; automotive, financial services, real estate, retail and healthcare; employing more than 35,000 employees across more than 20 countries in the Middle East, Asia and Africa, Al-Futtaim Group partners with over 200 of the world's most admired and innovative brands. Al-Futtaim Group’s entrepreneurship and relentless customer focus enables the organisation to continue to grow and expand; responding to the changing needs of our customers within the societies in which we operate.

By upholding our values of respect, excellence, collaboration and integrity; Al-Futtaim Group continues to enrich the lives and aspirations of our customers each and every day.

We are currently seeking an experienced finance professional to join our Finance Shared Service Center team in the capacity of Senior Accountant – TxBOT.

Overview of the role

The Senior Tax Accountant will support the Tax Back-Office of the Al-Futtaim Group on tax operational matters including preparations of Direct and Indirect Tax Returns.

The successful candidate will work closely with Group Tax in carrying out their responsibilities.

What you will do

Monthly Tax Returns Preparation

Prepare monthly VAT and WHT returns in of difference regions and process for submission to the governing bodies and liability settlement

Tax Compliance

Maintain regulatory compliance and updating the monthly calendar and tracker to ensure correct and timely filing of all Tax Returns based on country specific tax calendars and review complex income Tax Returns

Tax Accounting

Support the Tax Back-Office with the tax provision tracking and tax balances on general ledger

Tax Document Management

Ensure all documents are collected on a central database and handle requests for information

Tax Audits

Provide coordination support during tax audits to the Tax Manager

Automation

Provide active support to the Tax Back-Office in resolving VAT system issues in close coordination with IT and Assistant Financial Controller.

Support the Streamlining processes identified through automation

Tax Reporting

Prepare adhoc requests as per management request

Other Key Responsibilities

To liaise with relevant managers and stakeholders to ensure full collaboration and understanding on critical topics.

Contribute to the improvement of the solutions and business processes.

Maintains and upgrades professional knowledge, management skills and domain expertise by using continuous learning & development tools.

Required skills to be successful

Accounting skills

Project management skills

SAP Knowledge preferable

Ability to work on various on-going projects with good organisational and time management skills

Microsoft Office, particularly Excel

Analysis and troubleshooting

What equips you for the role

Tax, Finance Degree, Regional tax knowledge would be a plus

3 - 5 years of GCC Tax experience

1-2 years in an international Finance environment

We’re here to provide excellent service but a little help from you can ensure a five-star candidate experience from start to finish.

Before you click “apply”: Please read the job description carefully to ensure you can confidently demonstrate why this opportunity is right for you and take the time to put together a well-crafted and personalised CV to further boost your visibility. Our global Talent Acquisition team members are all assigned to specific businesses to ensure that we make the best matches between talent and opportunities. We not only consider the requisite compatibility of skills and behaviours, but also how candidates align with our Values of Respect, Integrity, Collaboration, and Excellence.

As part of our candidate experience promise, we also want to make ourselves available to you throughout the application process. We make every effort to review and respond to every application.

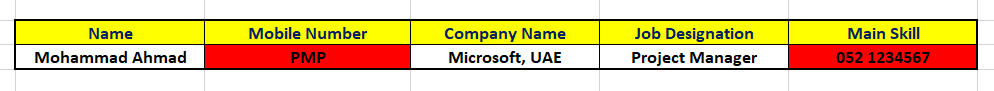

DETAILS TO REGISTER FOR THIS JOB:

NOTE: ATS-compliant CV is MANDATORY!

https://www.afuturewithus.com/job/Dubai-Senior-Accountant-TxBOT-Finance-Shared-Service-Center-Corporate-Services/1042002401/NOTE: ATS-compliant CV is MANDATORY!

Applied For Many Jobs, But Didn't Get Any Interview Calls? Apply For This Job Using a Branded AI-compliant ATS-Friendly CV from Dubai-Forever.Com.

What is an ATS CV?

Applicant Tracking System or "ATS", is the software that 'READS' your CV and stores this information in a database. Like this:

If the CV is not made as per the RULES of the ATS, the information will get messed up in the database. Like this:

And, you may never be found by the recruiter, in spite of your 'CV information' existing in the database...

...And, you'll keep wondering why you get rejected in spite of being a PERFECT MATCH for the Job.

Read more about the ATS CV:

https://www.dubai-forever.com/cv-writing-services.html#ATS-Compliant-CV

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

What's the most IMPORTANT thing you should read about a CV Writing Service?

Client Satisfaction Reviews, right?

You'll get a fair idea whether to purchase that service or not.

Read the recommendations our customers have written on my LinkedIn profile.

Click the LinkedIn banner below and then scroll down to the Recommendations section.

Navigate here for more testimonials/feedback about our expertise and results:

www.dubai-forever.com/resume-writing-feedback.html

www.dubai-forever.com/cv-writing-reviews.html

Also, read reviews about "www.Dubai-Forever.Com" on TrustPilot.com, the world's must trusted review site...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

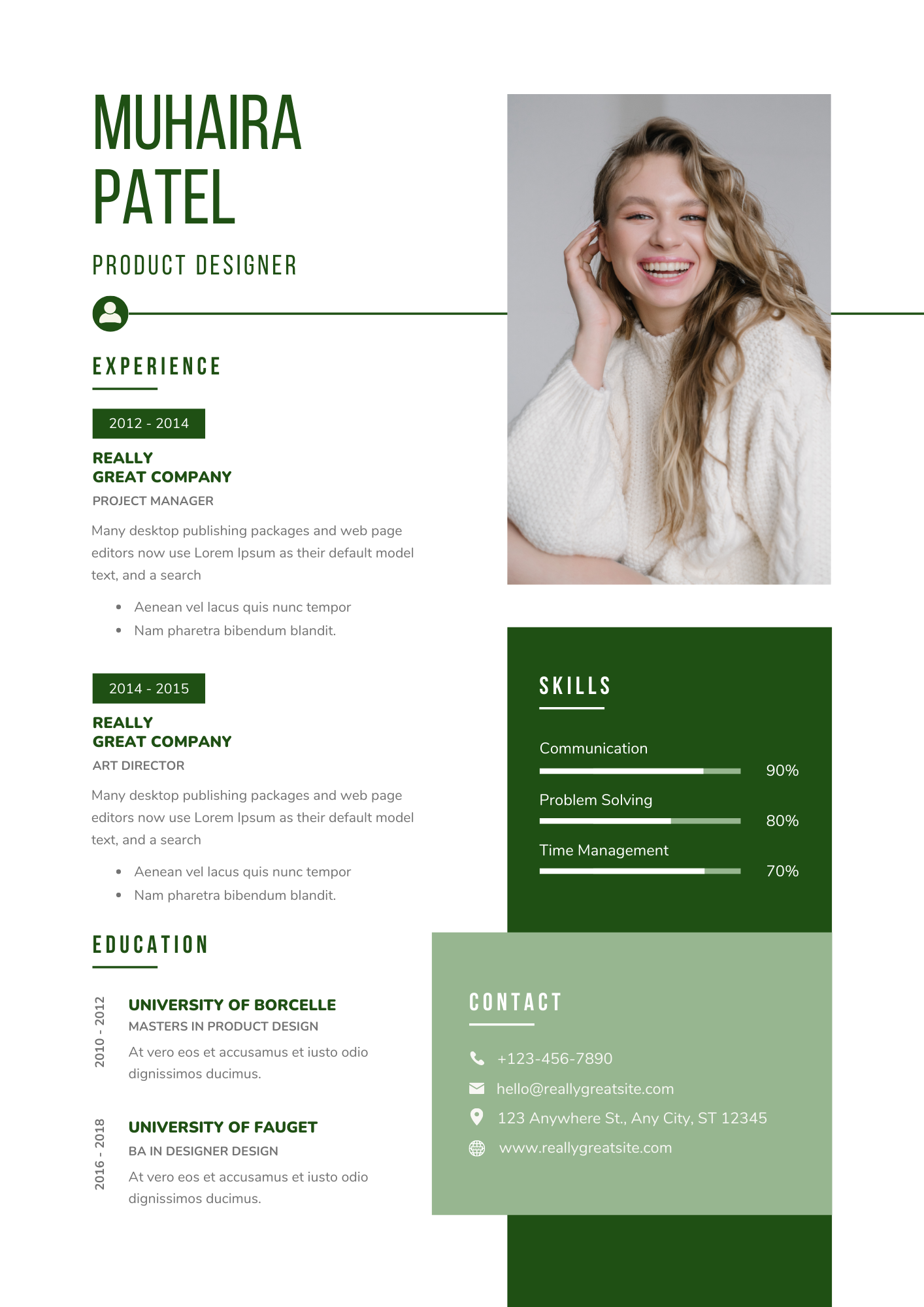

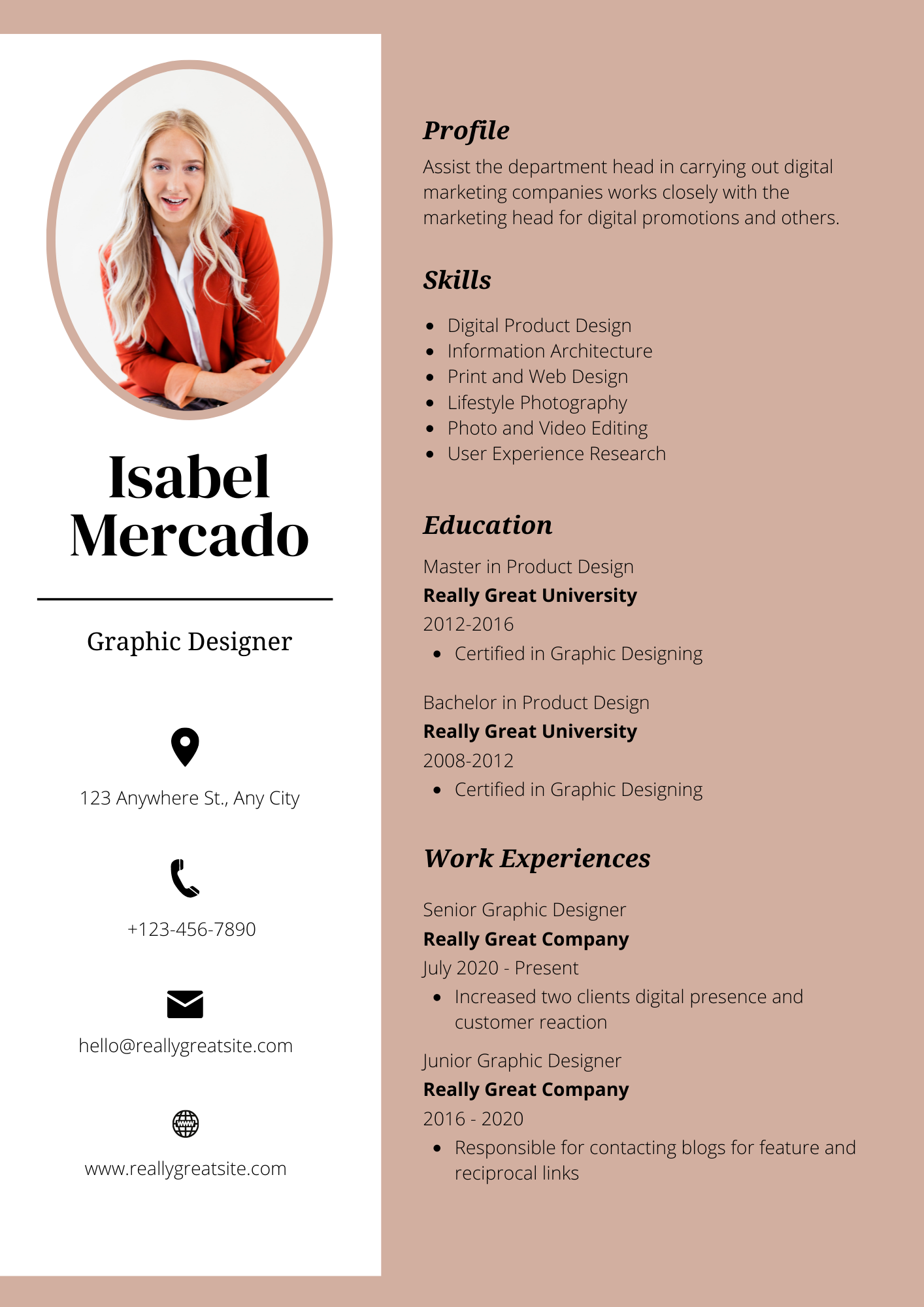

Want CV Samples & Templates for FREE?

Click on the CV's below to begin:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Fastest Growing Jobs Group on LinkedIn:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Middle East's Best Job Groups on Whatsapp:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join our Telegram Group:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Submit your CV here, as well:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

We support the Far-Sighted, Growth Oriented Vision announced by the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

It's an exciting time and the next 30 - 40 years will be those of the GCC countries.

Excited about working in the GCC? Click on one of the banner's below...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

SOCIAL INITIATIVE:

We publish job vacancies on this website and our Whatsapp groups for the benefit of job-seekers.

It is to help people who are searching for jobs from across the world.

This is a Social Initiative from our team @ dubai-forever.com, so please help us in this Noble Task by Forwarding these jobs within your Network.

Do this GOOD DEED.

You never know who will benefit from it.

You've heard about KARMA right?

It's waiting to give you 10X of whatever you do...Do the Good Deed. NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

No comments:

Post a Comment