Our globally coordinated tax professionals offer connected services across all tax disciplines to help our clients thrive in an era of rapid change. We combine our exceptional knowledge and experience with the people and technology platforms that make us an ideal partner for all their tax-related needs. In Tax, we equip clients to make better business decisions by bringing insights to the forefront. We help companies understand the tax policies and tax laws of governments around the world to plan and comply accordingly.

Our teams leverage transformative technologies to deliver strategy and execution, from tax and regulatory obligations to operations and workforce management, to reduce risk and drive sustainable value. Tax has six sub-service lines which cover a wide range of issues: Business Tax Services, Global Compliance and Reporting, Global Law, Indirect Tax, International Tax and Transaction Services and People Advisory Services.

The opportunity

This is an excellent opportunity for an experienced Tax professional to join a growing team in an emerging market. As an International Tax Senior Manager, your primary focus will be advising global companies on the various regional and international tax implications of their operations. With so many offerings, you have the opportunity to develop your career through a broad scope of engagements, mentoring and formal learning. Our Tax service line in MENA is experiencing a period of significant growth so now is an excellent time to join. Sound interesting?

Your key responsibilities

You will be managing the successful delivery of international tax engagements and assisting partners / directors with generating new business opportunities and building client networks and relationships. You will be contributing to building and maintaining key client relationships by delivering exceptional client service and collaborate with a team of International Tax professionals across the MENA region and globally to combine diverse cross-border experience with local tax knowledge across a broad spectrum of industries.

You will be expected to work as part of a multi-jurisdictional / disciplinary team within tax and across other service lines (including working with colleagues from Transfer Pricing, Transaction Tax, Indirect Tax, People Advisory Services etc.) in terms of pursuing, managing and delivering engagements and assisting in managing engagement economics by organizing staffing, tracking fees and communicating issues to project leaders. You will build strong internal relationships within international tax team and across other service lines and you will counsel and develop more junior staff through delegation and on the job training.

Skills and attributes for success

If you are a client driven, strategically and commercially aware, excellent communicator in a range of situations both written and oral, enthusiastic with flexible attitude to work and a strong motivator, you will be perfect for the role.

To qualify for the role you must have

Bachelor's Degree in Tax, Economics, Accounting or Finance and an approved professional qualification or equivalent (e.g. ADIT / ATT / ACCA / CPA / ACA / CA / LLB or MBA, or MA, MSc or PhD in fields listed above)

7 – 8 years of relevant tax experience

Broad exposure to international taxation with focus on inbound and outbound investments

Strong managerial, organisational, project management, analytical and verbal/written communication skills

Proven track record with a leading professional services firm

Experience of managing a team and/or mentoring and developing more junior team members

Ideally, you’ll also have

Proficiency in Arabic language

What we look for

You’ll proactively maintain your technical knowledge by keeping abreast of global developments in international tax landscape so that you can better advise our clients. In return we’ll provide investment in the right sort of training and offer you the opportunities on projects and assignments that will develop and challenge you so that you’re in the best place to develop your tax career.

The types of project you’ll contribute towards may include:

Expansion into new markets

Group structure reorganization and /or rationalisation

Review of operating model including permanent establishment risk, withholding taxes, transfer pricing etc.

Review of Group holding structure, capital structure and financing arrangements

Review of IP structure

BEPS risk assessments

Whatever the projects and assignments you work on you can be confident that you’re contributing towards helping our clients to develop and execute their international tax strategy ensuring technical excellence and providing the highest levels of client service.

Apply For This Job Using a Branded ATS-compliant CV from Dubai-Forever.Com.

What is an ATS CV?

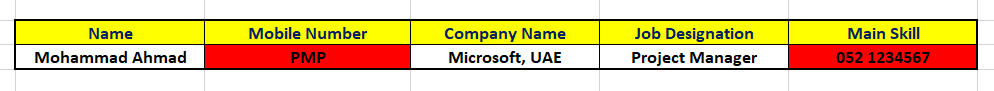

Applicant Tracking System or "ATS", is the software that 'READS' your CV and stores this information in a database. Like this:

If the CV is not made as per the RULES of the ATS, the information will get messed up in the database. Like this:

And, you may never be found by the recruiter, in spite of your 'CV information' existing in the database...

...And, you'll keep wondering why you get rejected in spite of being a PERFECT MATCH for the Job.

Read more about the ATS CV:

https://www.dubai-forever.com/cv-writing-services.html#ATS-Compliant-CV

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

What's the most IMPORTANT thing you should read about a CV Writing Service?

Client Satisfaction Reviews, right?

You'll get a fair idea whether to purchase that service or not.

Read the recommendations our customers have written on my LinkedIn profile.

Click the LinkedIn banner below and then scroll down to the Recommendations section.

Navigate here for more testimonials/feedback about our expertise and results:

www.dubai-forever.com/resume-writing-feedback.html

www.dubai-forever.com/cv-writing-reviews.html

Also, read reviews about "www.Dubai-Forever.Com" on TrustPilot.com, the world's must trusted review site...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Want CV Samples & Templates for FREE?

Click on the CV's below to begin:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join the Middle East's Best Job Groups on Whatsapp:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join the Fastest Growing Jobs Group on LinkedIn:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join our Telegram Group:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Submit your CV here, as well:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

We support the Far-Sighted, Growth Oriented Vision announced by the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

It's an exciting time and the next 30 - 40 years will be those of the GCC countries.

Excited about working in the GCC? Click on one of the banner's below...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

SOCIAL INITIATIVE:

We publish job vacancies on this website and our Whatsapp groups for the benefit of job-seekers.

It is to help people who are searching for jobs from across the world.

This is a Social Initiative from our team @ dubai-forever.com, so please help us in this Noble Task by Forwarding these jobs within your network.

Do this GOOD DEED.

You never know who will benefit from it.

You've heard about KARMA right?

It's waiting to give you 10X of whatever you do...Do the Good Deed. NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

No comments:

Post a Comment