Majid Al Futtaim invites you to join us in our quest to create great moments for everyone, everyday! We are the leading shopping mall, residential communities, retail and leisure pioneer across the Middle East, Africa and Asia, serving over 560 million visitors a year. For the past two decades, we have shaped the consumer landscape across the region, transforming the way people shop, live and play, while maintaining a strong sustainability track record and the largest mall in the world to attain LEED Gold EBOM Certification. We have over 40,000 team members in 15 international markets representing over 100 nationalities – all keeping the customer at the heart of everything we do. If you enjoy being BOLD, PASSIONATE and TOGETHER, then Majid Al Futtaim is the destination for you.

Role Purpose:

The Tax Manager is responsible for supporting the Head of Tax in all Tax operations including monitoring master data, monitoring transaction data, monitoring IT systems for tax compliance, adapting to tax automation, managing compliance, tax reporting and audits, dealing with tax authorities, providing consulting support to the business teams on matters relating to tax policies and procedures. The ideal candidate is experienced in retail business, tax and accounting and can support the accurate preparation and filing of our company’s Tax Returns, is a team player who executes the tax responsibilities with efficiency and accuracy, creates and implements tax plans and works with the accounting and business teams to identify and drive opportunities for process improvement and highlight and manage potential areas of risk. The Tax Manager will ensure compliance with the country tax laws through a series of systems and system controls that are designed to ensure accurate, timely reporting. They will monitor changes to tax regulation and support the Head of Tax to make the appropriate updates to policies and strategies.

Role Details – Key Responsibilities and Accountabilities:

Tax Laws

Understand the implications of tax laws and advise on tax related issues to ensure compliance with applicable laws and regulations

Application and interpretation of the country’s tax code and their implementation

Stay updated on Tax Laws and providing working knowledge to concerned stakeholders

Tax Advice

Understand the IT systems and process flows and documents of the company and the tax implications thereon.

Provide support in order to minimize tax risks associated with business operations, contracts and all other areas of tax compliance.

Facilitate resolution of tax audit exercises within the operating jurisdiction

Master Data & IT System Controls

Continuous review & monitoring of Master Data & system controls affecting tax compliance

Support & coordination with business, finance & IT teams to ensure Master Data & system controls affecting tax compliance

Adapt and adopt tax automation

Record keeping and Reporting

Conduct periodical audits and reviews as per the advice of the Tax Senior Manager and Head of Tax to ensure compliance with VAT & Excise Rules and Regulations of the country and any other taxes that may be made applicable in the future.

Prepare and maintain documentation and records and reports relating to the company’s tax returns and other submissions in relation to queries, audits etc.

Prepare and maintain reconciliations to support tax data in relation to the company’s financial and other records.

Document and maintain working papers in relation to company’s process flows, tax advice etc.

Human Capital Responsibilities

Productive collaboration with the business teams to engage in matters of tax impacting the business and vice versa.

Proactively identify and seek professional development opportunities to improve leadership and technical skills pertaining to the direct line of work.

Apply and follow MAF Retail’s Human Capital corporate policies and relevant procedures and instructions.

Definition of Success

Managing tax risk by prevention of non-compliance and penalties through ensuring quality of master data and system controls, quality of documentation, audits and reviews of documents and reports

Timelines of compliance

Prevention of Tax Leakage

Automation of Tax Processes

Other Context (if applicable):

N/A

Functional/Technical Competencies

Working knowledge in Indirect Tax Law & Commercial and business laws of the country

Preferably knowledge of Retail business

Sound knowledge of Finance & Accounting

Knowledge of Master Data Management

Working knowledge of ERP systems and ability to train and understand the IT and reporting systems to take out reports for tax related submissions.

Personal Characteristics and Required Background:

Minimum Qualifications/education

Bachelor Degree in Commerce / Economics / Finance

Preferred experience in dealing with following systems and reports

Experience in handling the following is preferred

All financial, inventory & payroll reports in a business

Tax reports & returns

Reconciliations

Providing tax support for different business area on booking.

Skills

Knowledge of VAT, Excise & Other applicable tax laws in the UAE

Understanding of all IT & Master Data controls in Tax compliance

Excellent Finance & Accounting skills

Excellent excel and analytical skills

Ability to use ERP systems and reports for accounting, inventory, payroll, financial reporting and control etc.

High attention to detail

Effective communication skills and the ability to train self and others

Time management and organizational skills

Good problem-solving skills

Ability to deal with targets & timelines and manage stress

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

We support the Far-Sighted, Growth Oriented Vision announced by the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

It's an exciting time and the next 30 - 40 years will be those of the GCC countries.

Excited about working in the GCC? Click on one of the banner's below...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

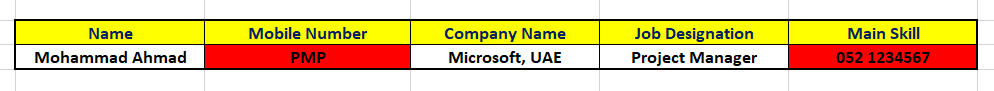

Apply For This Job Using a Branded ATS-compliant CV from Dubai-Forever.Com.

What is an ATS CV?

Applicant Tracking System or "ATS", is the software that 'READS' your CV and stores this information in a database. Like this:

If the CV is not made as per the RULES of the ATS, the information will get messed up in the database. Like this:

And, you may never be found by the recruiter, in spite of your 'CV information' existing in the database...

...And, you'll keep wondering why you get rejected in spite of being a PERFECT MATCH for the Job.

Read more about the ATS CV:

https://www.dubai-forever.com/cv-writing-services.html#ATS-Compliant-CV

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

What's the most IMPORTANT thing you should read about a CV Writing Service?

Customer Reviews, right?

You'll get a fair idea whether to purchase that service or not.

Read the recommendations that some of our clients have written on my LinkedIn profile.

Click the LinkedIn banner below and then scroll down to the Recommendations section.

Navigate here for more testimonials about our expertise and results:

www.dubai-forever.com/resume-writing-feedback.html

www.dubai-forever.com/cv-writing-reviews.html

Also, read reviews about "www.Dubai-Forever.Com" on TrustPilot.com, the world's must trusted review site...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

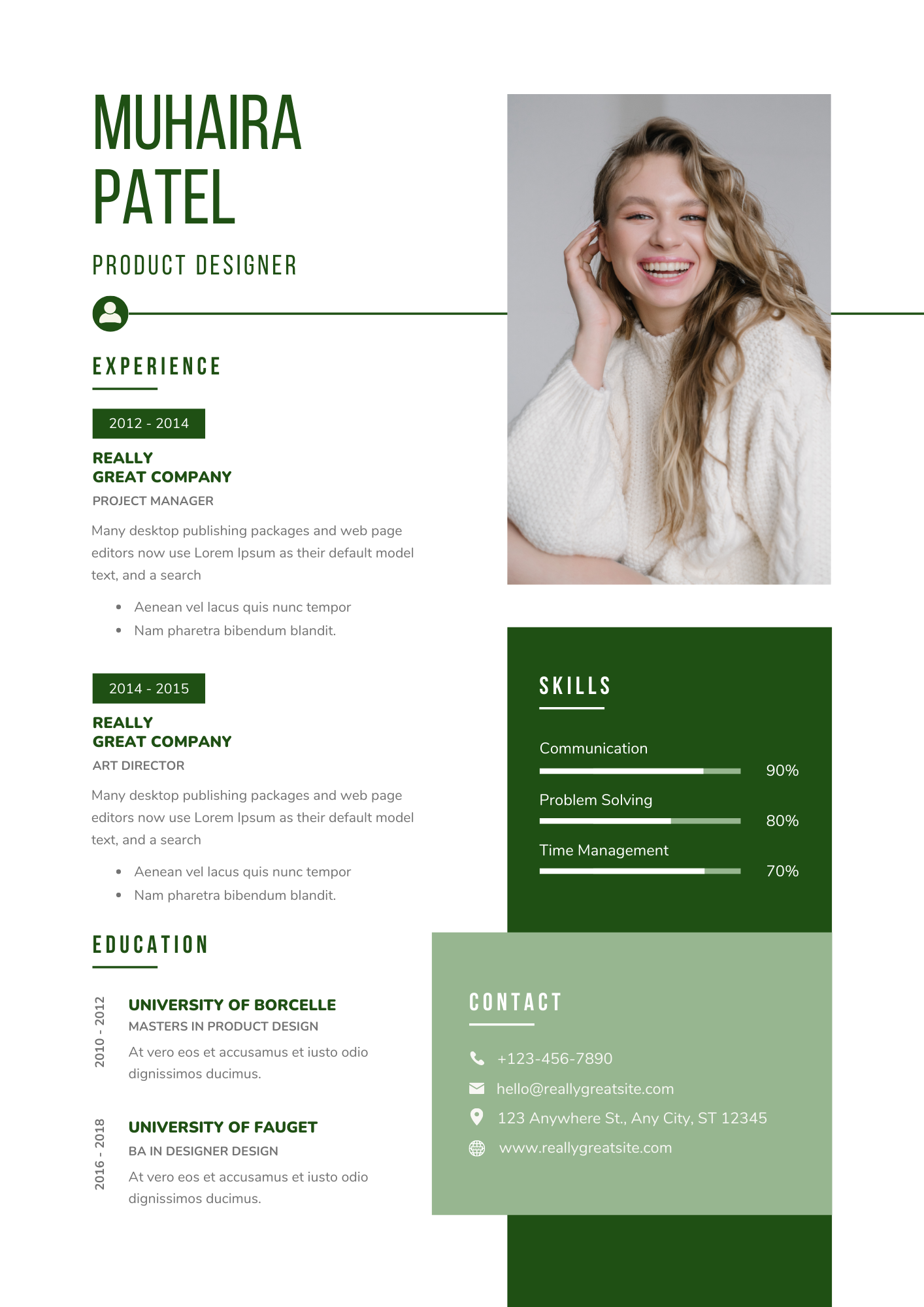

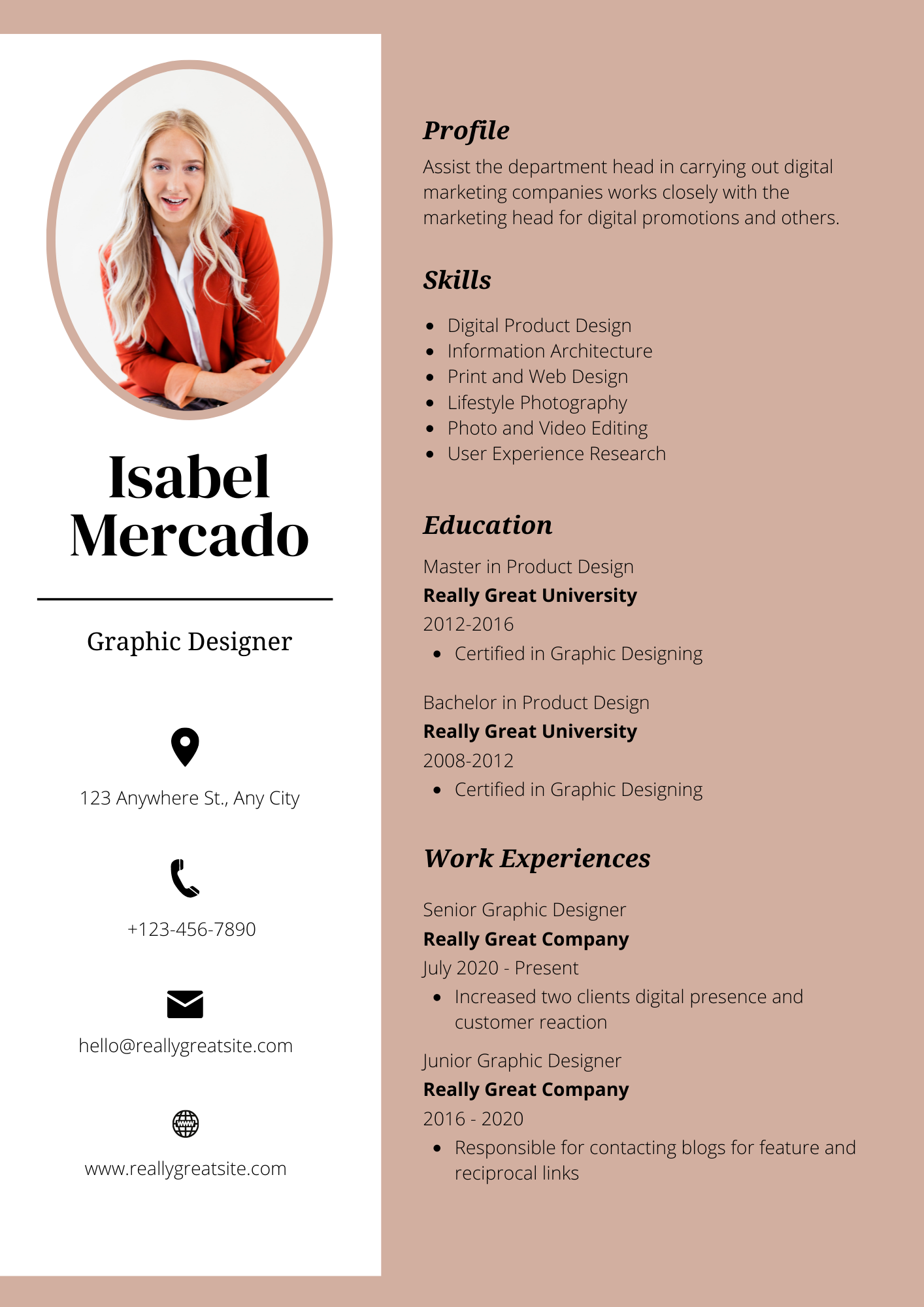

Want CV Samples & Templates for FREE?

Click on the CV's below to begin:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join the Middle East's Best Job Groups on Whatsapp:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join the Fastest Growing Jobs Group on LinkedIn:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join our Telegram Group:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Submit your CV here, as well:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

SOCIAL INITIATIVE:

We publish job vacancies on this website and our Whatsapp groups for the benefit of job-seekers.

It is to help people who are searching for jobs from across the world.

This is a Social Initiative from our team @ dubai-forever.com, so please help us in this Noble Task by Forwarding these jobs within your network.

Do this GOOD DEED.

You never know who will benefit from it.

You've heard about KARMA right?

It's waiting to give you 10X of whatever you do...Do the Good Deed. NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

No comments:

Post a Comment